Investing in Multifamily

What is Multifamily?

Multi-family residential is a classification of housing where multiple separate housing units for residential inhabitants are contained within one building or several buildings within one complex. Units can be next to each other or stacked on top of each other. A common form is an apartment building.

What makes Multifamily a good investment?

- Multifamily investments help you grow your portfolio in less time and are also appropriate for the investors with intend to build a relatively large portfolio of rental units.

- Multi-family investments offer better returns with less risk than other investments.

- It is easier and time-efficient to acquire a 50 units apartment building than purchasing multiple single-family.

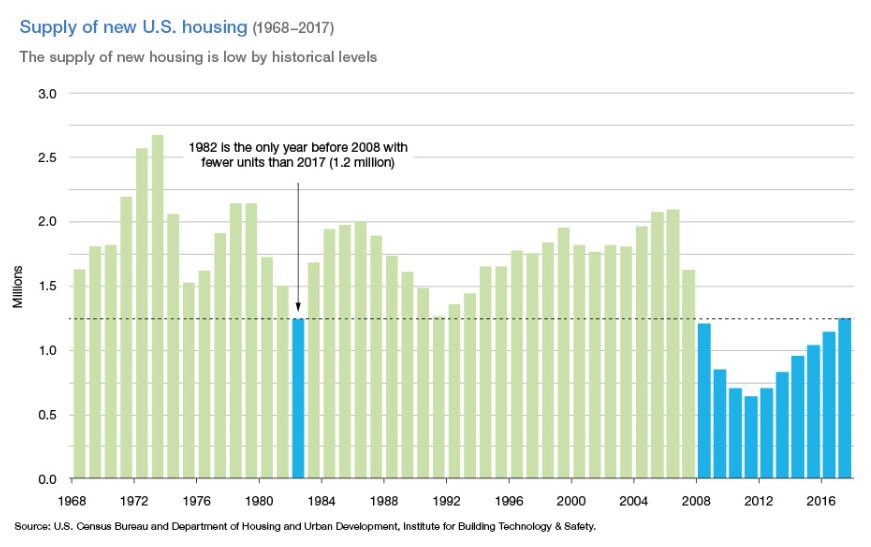

- According to the U.S. Census, the apartment absorption rate is growing exponentially and CBRE’s 2020 U.S. Outlook predicts a very good year for commercial real estate.

- Millennials are more about experiencing life and more into renting than buying. A perfect example is all the new market disrupters like Uber, Airbnb, etc.

What is the equation behind renting vs. buying?

More people are renting today since 1965, buying a home is no longer a key priority. The younger generations have a different outlook on life. They want to live life, experience life, and create moments in life. Their philosophy is to “Live in the Moment’. They are not into buying and hoarding stuff like past generations. Some key factors behind renting mindset::

- More mobility and flexibility and are not tied to one place or house.

- The young generation and college graduates can’t afford to buy a house.

- Immigrants come to the U.S and immigrants’ rate is increasing.

- Avoid commute and live closer to jobs in the city.

- Some financial challenges create the need for temporary and affordable housing.

- No taxes, interest, or maintenance costs.

- Savings with amenities like a gym, pool, etc.

- More secure. Some apartment complexes are gated 24-hour security.

Our Acquisition Criteria

We buy properties in emerging markets.

What is an emerging market?

An emerging market is a market that has some characteristics of a developed market but has ample room for growth. Some indicators for emerging markets:

- Economic growth

- Job growth

- More tech companies moving into the area

- Property values and rents are rising

- More people moving into the area

- Political stability

- Overall huge growth potential

Market Analysis

Loomba Investment Group conducts thorough market analysis and studies the market trends before making an investment.

What is Market analysis:

Market analysis provides a holistic picture of the market. It is an assessment to determine how suitable a particular market is for real estate investments. We conduct in-depth market analysis to evaluate the current markets and use business intelligence for future projections. Market analysis identifies the market appeal and detects the current and future risks involved.

Conduct Market Analysis:

We look at various characteristics of a market while conducting a market analysis. We use a data-driven approach to determine how lucrative an investment opportunity will be in a target market for our investors. We also, conduct a competitive analysis to determine our exit strategy.

Monitor Market Cycle:

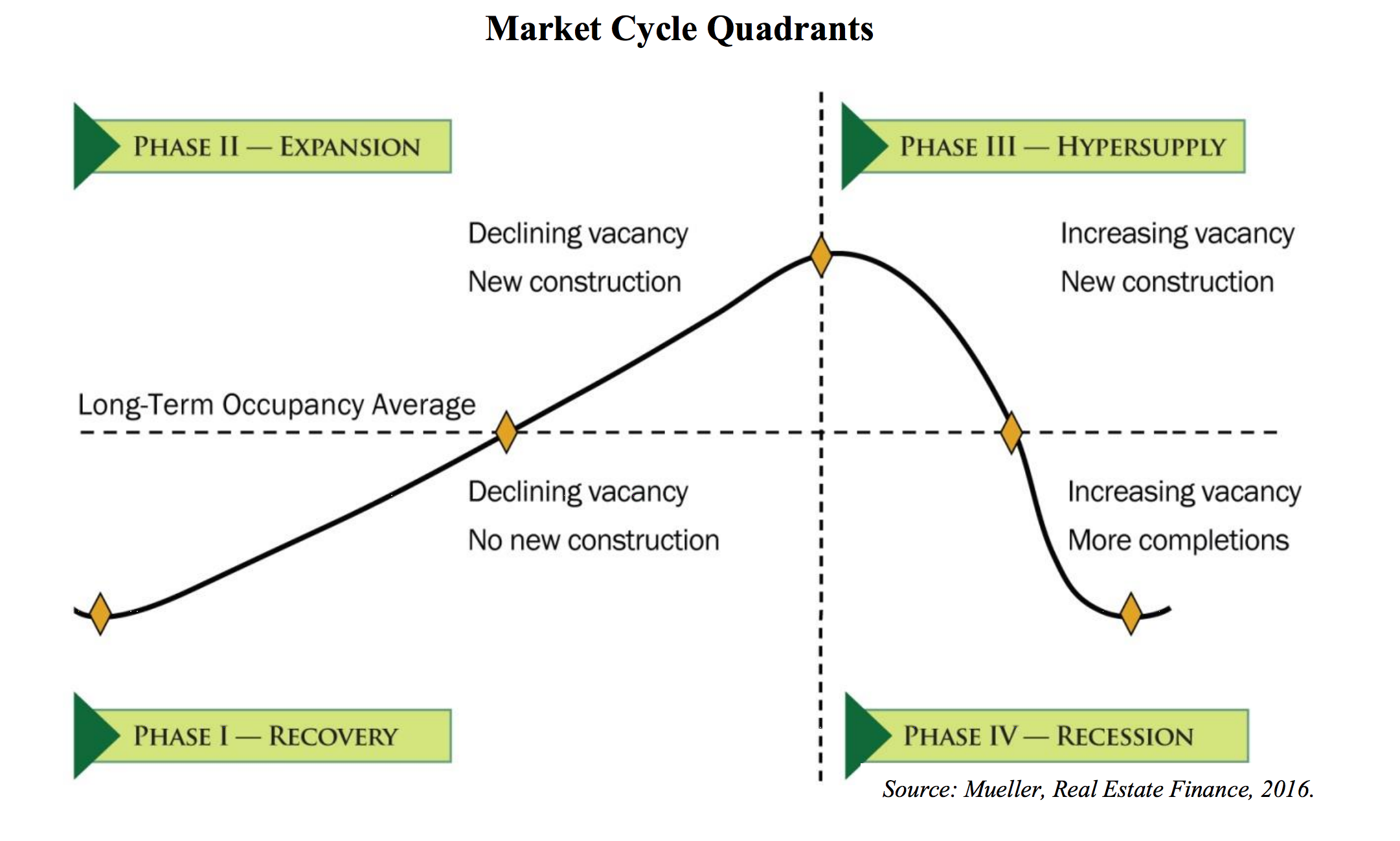

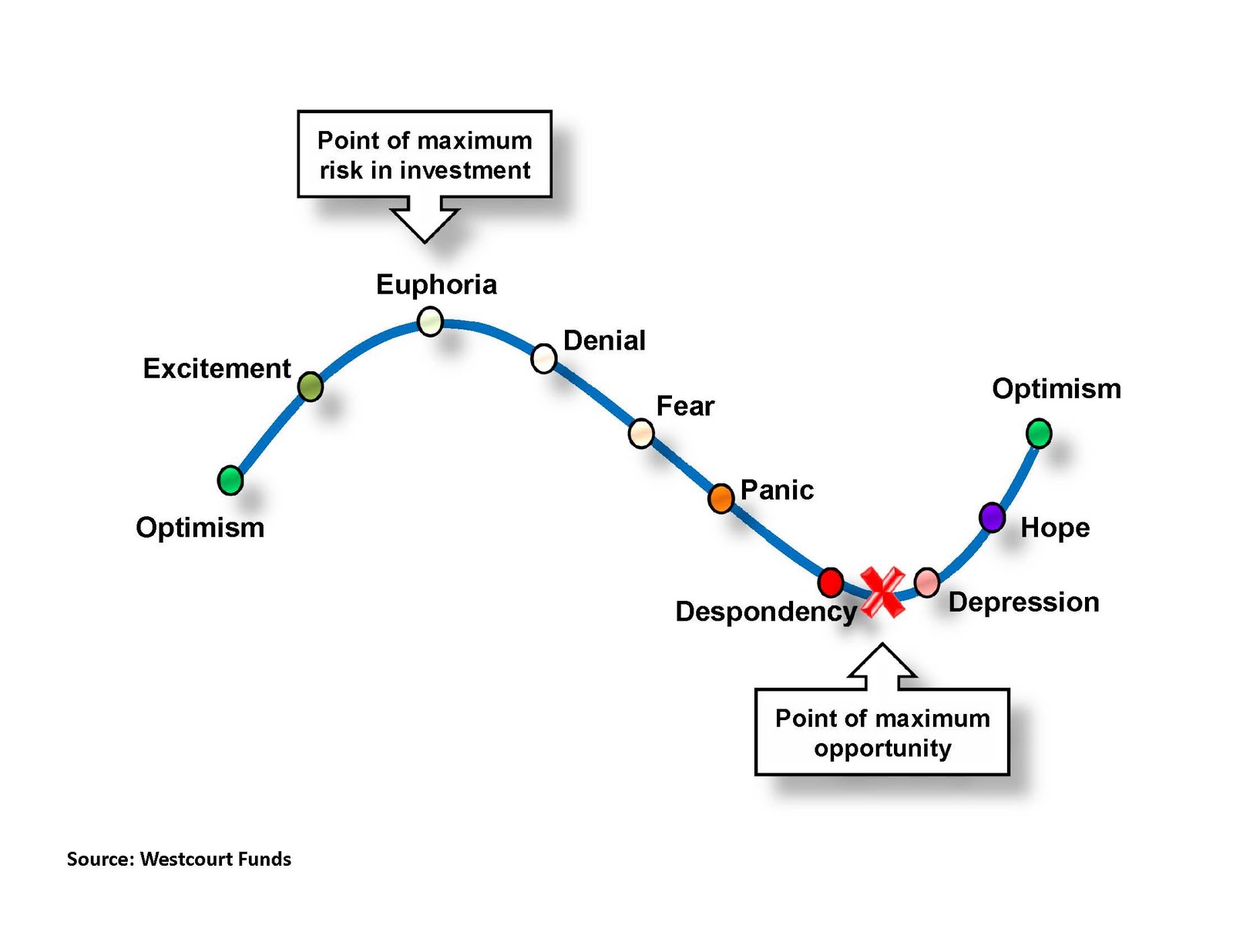

Commercial real estate is a cyclical market. There are four phases to the real estate cycle. It’s critical to understand the progression of each phase with heightened sensitivity to identify investment opportunities, and risks, within the cycle especially when phases are on the verge of transitioning.

Four Phase of Market Cycle

1. Recovery Phase:

A phase of a low or no new construction and rental rate growth is negative to flat. The market is oversupplied. During this phase, the real estate market is at its lowest point. The unemployment rate is high and the foreclosure rate is on the rise. Prices are flat and vacancy rates are declining during this phase. If you can buy and hold and this might be a good time to find a good value add property. If you are a risk-taker, this might be a time to invest in a value-add property (buy low and sell high at a later date after rehab).

2. Expansion Phase:

During this phase, an improvement in vacancy and occupancy rates is seen with a rise in the prices and rents. We can call this phase ‘a state of equilibrium’ because, in this phase, supply and demand for real estate are in balance. The market is on the upswing in terms of growing demand and absorbs oversupply. Development activity begins to return means existing properties are rehabbed – an opportunity for value add investors to improve their acquisitions.

3. Hyper Supply Phase:

During this phase, there’s more new construction however the absorption rate is low to negative. The overbuilding in the expansion phase leads to more supply than demand which results in higher vacancy rates. The employment growth is low to moderate with low to medium rent growth. It makes it hard for investors to maintain profitability. This phase is, usually a paradigm shift in the economy because it moves the real estate cycle into the recession phase.

4. Recession Phase:

During this phase, supply outweighs demand and the vacancy rate increases. There’s low to moderate new construction with a low absorption rate. Employment growth is low to negative and rent growth during a recession is low to negative as well. More concessions and rent reductions are offered to entice and retain tenants. It is a good time for opportunistic investors to find distressed and foreclosure properties. They can buy low, improve, reposition, hold, and exit at the right time.

Strategy and Market Cycle:

An investor needs to understand the four phases of the market because the investment can be successfully made across all four phases of the market cycle. However, the investors have to be cognizant of the fact that the four phases do not occur in equal periods. One period (recovery phase) can be brief and can transition quickly to other (expansion phase), or it may linger longer. The real estate cycles vary depending upon geographic locations and asset classes.

Loomba Savvy Investors Club educates its investors about the market and also provides different investment strategies in between different market cycles.

Pre-Qualify for Savvy Passive Investors Club!